- Inflapro is the calculation for method of inflation protected return on Investment

- It provides periodical payout on FD or pension on a Principal amount at increased value to the extent of inflation protection compared to the previous year same period

- For example if the principal is Rs. 100000 and interest rate is 8% pa compounded annually then in a conventional method one gets equal amount of rs. 8000 per year. In inflapro method depending on inflation protection level and other parameters one may get around 5000 in first year 5500 in second year and so on

- This site www.bnvenkat.com and look for INFLAPR links which provides a chart of dozen schemes equivalent to one type of conventional method of pay out.

- There is another site www.bnv.bvraghav.com wherein for each of dozen options other custom parameters one can use the provided calculator and workout detailed statements with audit proof calculatations with brought forward and carry over figures and the periodical interest posting and payouts

Kanpur Add: B N Venkataraman, c/o B V Raghav dept:design, E4 SBRA(Single bed room apartments),

IIT Kanpur, 208 016

Jeevan Akshay IV and then revised VI

LIC is offering following options in their immediate pension schemes

vide these schemes

Option (i) Annuity payable for life at a uniform rate.

Option (ii) Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

Option (iii) Annuity for life with return of purchase price on death of the annuitant.

Option (iv) Annuity payable for life increasing at a simple rate of 3% p.a.

Option (v) Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Option (vi) Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Option (vii) Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor.

The above options are conventional ones except the option(iv). BNV's inflapro has a number of options are suggestions with inflation protected returns to customer, and the inflapro is all about calculating the starting amount for a particular inflapro option extended to each of the above conventional options. Even though a inflation protection of 10% per annum is considered in this case study, BNV's said website provides flexible calculations with varying parameters of inflation constant and expected length of life in other words the full term. With expected life span of 85 years for an annuitant of age 60 is 25 years.

Inflapro's unlimited options

Therefore the options that can be made available to customer is unlimited (in the sense plenty). For each of above 9 options (option iv excluded)

There can be further 11 options (or even more with varying moratorium periods), giving rise to 108 options and also with varying degree of 1% to 10% in step of 0.5 percent, there can be as much as 20 options. In all there can be as much as 2160 options plus the existing 3% inflated option without return of purchase price.

In case of existing 3% fixed inflation prortection and even after the full term of say 25 years on survival for further 15 years, The eroding of profit in such

a case to the LIC is heavy. In case of 80 years old customer the interest burden to LIC works out more than 21.63% pa for extended years of 15 years throughout.

However, the annuity amount in initial periods are very low, and there is no return of purchase price, the scheme sustains because of premature deaths

before the expected life span of 85 years.

However, in the case of proposed inflapro scheme, the author suggests as much as 10% increase per year with return of purchase price as per NAV standing on the account of the customer. The details will be discussed in later pages.

Important: Since the annuity with inflation protection is exponential, the author proposes a terms limit applicable for the inflated annuity year by year, and to shell out only the last annuity amount for further period of survival over and above the full term.

Notes:

The amount of pension receivable by annuitant is available in table form in LIC' official website and is taken for

study by b n venkataraman and proposing Inflation protected schemes since the year 2010 in the above said inflapro page of the website.

So there are virtually a total of 10 options available with LIC and the table shows rates for ages 30,40,50,60,70, and 80.

As per the calculations in this site, for example for an amount of Rs. 423015, after allowing service tax by customer, the purchase price works out to Rs.416764 and corresponding annuity amount is Rs.30778 in the site shown by advisor, however with 1% incentive in the calculation of this site is working out to Rs. 29215 only. So the return on investment for pension i.e. the interest rate based on certain parameters is slightly higher than that present in this case study with purchase price of Rs. 423015 is 28,220 and to be prcise it is 28,219.99, for option (vii) above for a customer of age 60.

*The customer in consideration is of age 62 and the returns are slighty better than that for age 60. whereas the returns of ICICI is still poorer compared to customer of less age of LIC.

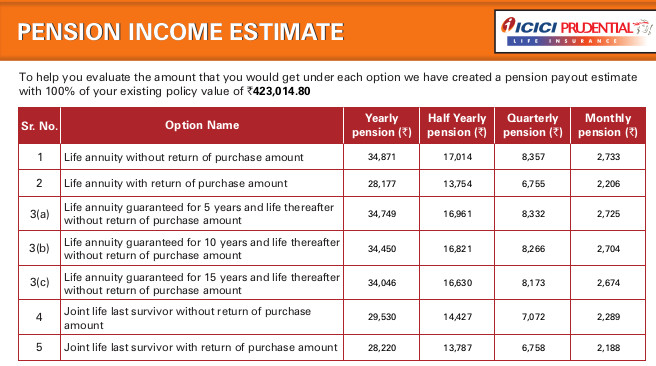

As per the letter to a customer from ICICI prulife, there are 5 options for annuity,

*the customer in consideration is of age 62 and the returns are slighty better than that for age 60. whereas the returns of ICICI is still poorer compared to customer of less age of LIC.WHAT IS SUPERANNUATION BENEFIT IN INDIA AND HOW IT IS TAXED?

November 16, 2015 by Shri Basavaraj Tonagatti reproduced from an informative website click to view site by a Certified Financial Planner by qualification and currently living in Bangalore.

Does your employer offer you superannuation benefit? Whether you know how it works and what are the tax benefits? Many employees not aware or never bothered. Because the contribution is not from their own pocket. Let us discuss more about this benefit.

Superannuation

features of this benefit of Superannuation

There are two types of superannuation benefits. One is called defined benefit-Under this, the benefits at retirement or pension are already known to an employee and it is fixed. Therefore, the risk of generating such defined benefit is purely on an employer (usually based on a formula linked to salary, years of service). The second one is called defined contribution-Under this, the contributions by employers is only known and fixed. However, the end benefits of retirement are not guaranteed. In such type of benefits, the risk is with an employee as he doesn’t know how much he will get at retirement.

The contribution to this benefit is purely by an employer. So nothing will be payable from your own pocket.

Usually an employer buys the product from insurance companies like LIC’s New Group Superannuation Cash Accumulation Plan and continues to contribute there.

The company pays 15% of your Basic+DA. This 15% is not fixed, but a maximum limit is 15%. Therefore, based on company rules, it may change from category of employees. However, there must be same contribution for a category of employer. For example, if a manager level category offered 15% superannuation, then all managers are eligible for 15% superannuation benefit. No single manager will be allowed to receive less than or more than that mark.

This contribution is invested by the managing company as per the guidelines set in the policy.

Once you attain a retirement age then you have two options. One is to withdraw 1/3 of such accumulated amount and 2/3 must be converted as a pension. The second option is to buy the pension product fully without commuting anything. Any such commutation is tax-free for an employee.

The returns of the funds may differ as each employer has the option to select the superannuation providing insurance company like LIC or ICICI. In LIC, this superannuation plan is an endowment type of product where returns will be not that much attractive. However, ICICI offers both ULIP and Endowment superannuation plans.

If an employee resigns, then he has an option to transfer his amount to the new employer (provided both trusts are approved). If the new employer does not have superannuation scheme, then he can withdraw the amount in the account (which is taxed accordingly) or retain the amount in the fund till the retirement age.

Once the superannuation trust is formed, then employer can’t stop contribution in the middle. The employer can stop the contribution only when the trust is wound up.

Type of annuity options available

It purely depends on the annuity provider. However, the common pension options are as below.

- Payable for life.

- Payable for life guaranteed for 5 yrs, or 10 years or 15 years

- Payable for life with a return of capital.

- Payable jointly on the life of husband and wife

What tax benefits of superannuation?

For taxation purposes, there are two types of superannuation. One is approved superannuation and another is not approved. This approval will be from IT Dept. The approved fund means a fund, which is approved and continues to be approved by the Commissioner in accordance with the rules set out in Part B of the Fourth Schedule of the IT Act. You can ask your employer about the status of superannuation.

Employer’s contribution to an approved superannuation fund is allowed as expenditure deduction for business under Section 36 (1) (iv), subject to limits set out in Rule 87 and 88 of the Income-tax Rules, 1962.

Income received by the trustees on behalf of an approved superannuation fund is exempt under Section 10 (25) (III). Usually, companies form a trust to avail tax benefits on the contributions made to the superannuation benefit.

Employee contribution (In case employee voluntarily opted, which is only possible in case of defined contribution, but not in the case of defined benefit) for an approved superannuation fund is eligible for deduction under Section 80C, subject to the limits set in Section 80CCE. Any commutation of the annuity is exempt from tax. Benefits payable on death or injury are exempt from tax. The employer’s contribution in excess of Rs 100,000 is treated as a perquisite in the hands of the employee under. Pension or Annuity will be treated as salary income and taxed accordingly.

Note-This whole of above information under under this section of Superannuation is generic purpose. Some features may depend on the insurance company your employer opted for superannuation.

Interest rate 8% | frequency: Monthly is equivalent to the following results: Result Yearly: 8.29995% .approx. 8.3% Result Halfyearly: 8.13452% .approx. 8.13% Result Quarterly: 8.05345% .approx. 8.05% Result MOnthly: 8% .approx. 8%

Inflapro and its application on pension

FUTURE VALUE in inflapro system

VIRTUAL tax saving in inflapro

The existing 3% inflation protected scheme of LIC says it is the pension payout only and allows the virtual tax saving clause.

Conventional options and Extended option 1

- For simplicity LIC options are represented in roman letters and inflapro extended option is represented in arabic letters of normal use.

- The inflapro option 1 is exactly identical to all the conventional options of LIC (i), (ii), (iii), (v), (vi) and (vii)

- The inflapro option 1 of LIC option (iv) is the conventional equivalent of life annuity same as that of LIC (i) for the calculated rate of interest corresponding to the option (iv).

- For LIC option (iv) one has to look to the chart(discussed in this heading itself) of inflapro in inflapro option 4. The start amount as well as yearly increase is shown in the chart. one can click that option 4 column for generation of audit table. To retain concurrence the inflapro option 4 i.e. extended option 4 of the LIC opt (iv) the same inflation constant of 3% is retained, even though the options shown in other columns of the chart are for 10% in this case study. Custom choice of inflation constant is permissible in this website.

Conventional LIC options rewritten in short

- LIFE ANNUITY

- GUARNTEED 5 OR 10 OR DEFAULT 15 OR 20 YRS AND FURTHER LIFE ANNUITY

- LIFE ANNUITY WITH ROP ON DEATH OF ANNUITANT

- LIFE ANNUITY WITH 3% INCREASE EVERY YEAR

- LIFE ANNUITY CONTINUED WITH 50% ON DEATH TO SPOUSE

- LIFE ANNUITY CONTINUED WITH 100% ON DEATH TO SPOUSE

- JOINT LIFE LIFE ANNUITY UNTIL DEATH OF LAST SURVIVOR AND WITH ROP ON DEATH OF LAST SURVIVOR

To prepare inflapro option chart for a given LIC option, follow the following steps.

It is important to note that the software developed by the author works satisfactorily with proper page print in FIREFOX browsers only. It works in

google chrome also but print page will not be satisfactory, as the chrome does not have formating to take page break given by programmer to take into effect. The software does not work

in IE. The author has not tried in other browsers.

Sample chart with 13 options are shown in this page at here unlike the above steps this sample chart does not have

clickable columns for audit table, but have links for column of option 1, 4, 7, 10 only. These are pre-calculated chart/tables unlike above steps.

Conventional option 1,2,3 and Inflapro extended options 4 to 12

To arrive at full term consider an life expectancy span of say 85 years and subtract the entry age subject to minimum gurantee terms and special consideration to entry age of 80 of policy holder.

It is unreasonable to have expectancy of 100 years as this will not give rise to any speculation by customer and also it will make LIC (pension provider) to have high profit margin. (in other words it can offer high rate of return).

The default considered in the calculations of the author in all his websites is 85

However the user and service provider has option to choose from 70 to 100.

With this 85 the full term years are shown in the side table

| Calculation full term for extended options figures in years | |||||||

|---|---|---|---|---|---|---|---|

| (..) | (1) | (2) | (3) | (4) | (5) | (6) | (sample) |

| Entry age | 30 | 40 | 50 | 60 | 70 | 80 | 62 |

| Expected life | 85 | 85 | 85 | 85 | 85 | 95 | 85 |

| Normal Full term | 55 | 45 | 35 | 25 | 15 | 15 | 23 |

| Full term for special case option(ii) guaranteed 20yrs | 55 | 45 | 35 | 25 | 20 | 20 | 23 |

Moratorium M2 is 10 years for full term of 20 years and above and 7 years for full term of 15 years |

|||||||

-

In sample case of entry age of 60 years in option (vii) with ROP the conventional pension amount per lac is Rs. 7010 and the

calculated interest rate is 7.53844% pa

- Inflapro extended option 1 is identical to conventional option 1

Further pension on survival beyond full term is same conventional amount and no difference between conv. and infla.

In the sample case of entry age 60 years the rate of pension in LIC option(vii) extopt (1) is same Rs. 7010 throughout life whether within full term or survival beyond full term

the pension is same Rs. 7010 per lac and ROP will be Rs.1,00,000. -

Inflapro extended option 2 is similar to conventional option 1 with a difference that pension starts after a period of M1*(5 years)(* see above side table) moratorium

Further pension on survival beyond full term is same conventional amount (same constant pension of the full term.

In the sample case of entry age 60 years the rate of pension in LIC option(vii) conventional amount of Rs. 7010 extopt (2) the pension starts from sixth year beginning throughout life whether within full term or survival beyond full term

the pension is same Rs. 10082 per lac and the ROP will be Rs. 1,33,738. -

Inflapro extended option 3 is similar to conventional option 1 with a difference that pension starts after a period of M2*(10 years)

(* see above side table) moratorium

The interest applied during moratorium for accumulation purposes is same as 7.53844% pa for the sample case

Further pension on survival beyond full term is same conventional amount (same constant pension of the full term.

In the sample case of entry age 60 years the rate of pension in LIC option(vii) conventional amount of Rs. 7010 extopt (2) the pension starts from eleventh year beginning throughout life whether within full term or survival beyond full term

the pension is same Rs. 14,500 per lac and the ROP will be Rs. 1,92,341.

All the above 3 options are conventional ones and existing profit margin in the above cases should be considered as bench mark for the profit margins of other inflapro options. - It is suggested that in case of with ROP or without ROP with MORATORIUM options, in any conventional option or extended option 2 and 3, for death of annuitant or the last survivor as the case may be the ROP be applied as per the principal of NAV. and the purchase of policy be effected from the date immediately after the moratorium period. That is to allow the fund to grow as per interest rate applicable as per age and option during the moratorium period without fund switches that was available during the building up of the superannuation fund.

-

In sample case of entry age of 60 years in option (vii) with ROP the conventional pension amount per lac is Rs. 7010 and the calculated interest rate is 7.53844% pa

-

Inflapro extended option 4 is comparable to conventional option 1

- In case of lic opt(iii) and (vii), Further pension on survival beyond full term is same conventional amount and no difference between conv.

and infla, beyond full term. and in case of premature cease of pension before full term also, there is no increase/decrease in profit component

to LIC (service provider)

in extended opt 4 as the lesser payout is compensated by varying NAV

because in all inflapro options the payout during early years are quite low compared to the conventional payout.

The ROP will be as per NAV. There is no increase or decrease in profit component of LIC (service provider) in the case of LIC options with ROP i.e LICopt (iii) and (vii) in any of the ext.opt(4 to 12). - In case of lic opt(i) (ii) (v) and (vi), Further pension on survival beyond full term is last inflapro pension amount and that is same as

the conventional amount

beyond full term, therefore there is no increase/decrease in profit margin beyond the full term say survival over 85 years. In case of premature cease of pension

before full term, there is more increased profit component to LIC (service provider)

than even the one mentioned in

the previous para for options with ROP in this extended option 4 compared to conventional ones

because in all inflapro options the payout during early years are quite low compared to the conventional payout.

However among these four non ROP options the option (iv) with ext.opt 4 has more edge on the profit to LIC as only 50% of pension that would have to be paid is given to spouse annuitant on death of the annuitant. -

In case of LIC opt (iv) and this extended option 4:

The payouts are identical with 3% annual increase during the full term and hence the profit margin is same as conventional one.

The payout for extended option beyond the full term is constant as the last pension and in the proposed system as a general rule for inflapro systems the inflation protection stops at full term unlike LIC's conventional one to continue 3% increase. Therefore for this option (iv) extended 4 the profit margin to LIC increases beyond say 85 years age

on survival beyond full term the pension is same Rs. 7010 per lac and ROP will be as per varying NAV within the full term and NAV after full term is 10.00 i.e. Rs.1,00,000.

THERE IS NO INCREASE OR DECREASE IN PROFIT COMPONENT OF LIC (SERVICE PROVIDER) IN THE CASE OF LIC OPTIONS WITH ROP FOR ALL EXTENDED OPTIONS COMPARED TO CONVENTIONAL ONE. - In case of lic opt(iii) and (vii), Further pension on survival beyond full term is same conventional amount and no difference between conv.

and infla, beyond full term. and in case of premature cease of pension before full term also, there is no increase/decrease in profit component

to LIC (service provider)

in extended opt 4 as the lesser payout is compensated by varying NAV

-

Inflapro extended option 5 is comparable to conventional option 2 with moratorium M1*(5 years).

- Increase/decrease in profit margin rule is same as that of extended option (4) discussed above.

- In case of LIC opt (iii) and (vii) i.e. with ROP there is no increase/decrease in profit margin within the full term

and neither increase or decrease beyond full term as discussed in ext.opt(4) above. - In case of LIC opt (i) (ii) (v) (vi) there is increase in profit margin for premature cease within full term

and there is no increase/decrease in profit margin beyond full term as discussed in ext.opt(4) above. - In case of LIC opt (iv) ext.opt(5) with 3% inflation protection to annuitant, there is no

increase/decrease in profit margin

But there is increase in profit margin to LIC for survival beyond full term i.e. surviving over 85/95 years as the case may be as discussed in ext.opt-4 above.

and ROP will be Rs.1,33,739 same as conventional one of extended option 2 discussed above.

THERE IS NO INCREASE OR DECREASE IN PROFIT COMPONENT OF LIC (SERVICE PROVIDER) IN THE CASE OF LIC OPTIONS WITH ROP FOR ANY OF EXTENDED OPTION COMPARED TO CONVENTIONAL ONE.- It is suggested that in case of with ROP or without ROP with MORATORIUM options, in any conventional option or extended option 5 and 6, for death of annuitant or the last survivor as the case may be the ROP be applied as per the principal of NAV. and the purchase of policy be effected from the date immediately after the moratorium period. That is to allow the fund to grow as per interest rate applicable as per age and option during the moratorium period without fund switches that was available during the building up of the superannuation fund.

-

Inflapro extended option 6 is comparable to conventional option 3 with moratorium M2*(10 years).

- Increase/decrease in profit margin rule is same as that of extended option (4) discussed above.

- In case of LIC opt (iii) and (vii) i.e. with ROP there is no increase/decrease in profit margin within the full term

and neither increase or decrease beyond full term as discussed in ext.opt(4) above. - In case of LIC opt (i) (ii) (v) (vi) there is increase in profit margin for premature cease within full term

and there is no increase/decrease in profit margin beyond full term as discussed in ext.opt(4) above. - In case of LIC opt (iv) ext.opt(6) with 3% inflation protection to annuitant, there is no

increase/decrease in profit margin

But there is increase in profit margin to LIC for survival beyond full term i.e. surviving over 85/95 years as the case may be as discussed in ext.opt-4 above.

and ROP will be Rs.1,92,341 same as conventional one of extended option 3 discussed above.

THERE IS NO INCREASE OR DECREASE IN PROFIT COMPONENT OF LIC (SERVICE PROVIDER) IN THE CASE OF LIC OPTIONS WITH ROP FOR ANY OF EXTENDED OPTION COMPARED TO CONVENTIONAL ONE.- It is suggested that in case of with ROP or without ROP with MORATORIUM options, in any conventional option or extended option 5 and 6, for death of annuitant or the last survivor as the case may be the ROP be applied as per the principal of NAV. and the purchase of policy be effected from the date immediately after the moratorium period. That is to allow the fund to grow as per interest rate applicable as per age and option during the moratorium period without fund switches that was available during the building up of the superannuation fund.

PROFIT MARGIN CHART FOR ALL CASES OF EXT.OPTION 4 FOR VARIOUS LIC OPTIONS

The mortality is considered for all ages right from age 61 to 100 for this entry age of 60.

SOLICITATION Vs Extended option 7 and sister options 8 and 9

We know that insurance is the subject matter of solicitation, the pension plans also started to be the matter of solicitation, without any return of purchase amount to the nominee.

Thus the gamble for the customer. If the customer lives for long he enjoys more return on the investment otherwise it is profit for the service provider.

However, later there is less return in proportion to the without ROP version and the service provider started giving the return of purchase price.

The same gamble is continued in extended option 4 of inflapro of the author in LIC options (i) (ii) (iv) (v) and (vi).

However even though the calculations are provided option (iii) and (vii) there is no gamble and the ROP has to be based on the NAV of the account of the annuitant and the NAV of ROP compensates the apparent loss to customer. There is no increase/decrease in profit margin in options with ROP and in all other cases there is increase for premature deaths before the full term considered in the inflapro.

In the case of extended option 4 for these ROP options the balance money worked out at the end of full term on the account after all payments is only the same purchase amount 100000 per lac or NAV 10.00.

That balance of NAV 10.00 can give only a pension of the conventional amount say for example 7010 for option(vii) of entry age 60.

This money of 7010 is too less beyond the full term comapared to last pension of the full term under the same inflapro scheme say Rs. 24,454 and the sum is too less under the condition of continued inflation.

The sister extended option 5 and 6 are the same side of the coin of option 4 discussed here.

So the author devised a scheme in the inflapro to sustain at least the last pension for the years beyond the full term finding a suitable balance at the end of the term so as to give a payout at least equivalent to the last inflapro pension drawn.

The NAV of ROP also increases considerably in extended option 7.

The last inflapro pension of say (Rs.17,565) which is less than that in extended option 4 is far far superior than the conventional amount of Rs. 7010.

Thus the birth of option 7 and sister options 8 and 9. IN THIS EXTENDED OPTION 7 THERE IS ALWAYS RETURN OF PURCHASE PRICE THAT TOO ON THE BASIS OF NAV. Therefore the option 7 should be applied for existing LIC option of (iii) and (vii) ROP only.

Even though one can specify the interest rate and generate the calculations, one can apply for other options of high rate of return on investment. But that is not logical. So the extended option 7 and the sister options 8 and 9 be applied for the options of annuity with ROP only.

IT IS A FAIR GAME AND NO GAMBLE NOR SOLICITATION FOR THE ANNUITANTS AND THERE IS NO LOSS / NO GAIN FOR BOTH CUSTOMER AND LIC (SERVICE PROVIDER) OVER THE COMMITTED INTEREST BURDEN OF FIXED INTEREST AMOUNT IN THIS OPTION LIKE CONVENTIONAL OPTIONS OF ANNUITY WITH ROP.

The yield is considerably higher (maximum among conventional as well as other inflapro options) because the annuitant is agreeing to save more money for later years to have inflation protection by sacrificing quantum of pension in early years.

Take the cases of extreme entry ages of 30 as well as 80 and have the knowledge of the inflapro of the author with an inflation protection of 10% per annum.

For entry age of 30 with Rs.100000 purchase price in (iii) with ROP the conventional amount is Rs. 6,890 per year per lac for the full term of 55 years. In inflapro option 7, the first pension amout at 30 is only Rs. 617 continues with a rise of 10% every year, the last pension at the full term is Rs. 1,06,203 and the ROP based on NAV is 15,41,434 an NAV of 154.1433. This is certainly very good proposition to fight the sustained inflation instead of receiving the paltry 6,890 pension or ROP of 100000 on NAV of 10.0000

The calculations and audit table of the author prove the point that there is no extra burden to LIC in executing this scheme.

Extended option 10 and sister options 11 and 12

IT IS A FAIR GAME AND NO GAMBLE NOR SOLICITATION FOR THE ANNUITANTS AND THERE IS NO LOSS / NO GAIN FOR BOTH CUSTOMER AND LIC (SERVICE PROVIDER) OVER THE COMMITTED INTEREST BURDEN OF FIXED INTEREST AMOUNT IN THIS OPTION LIKE CONVENTIONAL OPTIONS OF ANNUITY WITH ROP.

SMART OPTION EITHER CONVENTIONAL OR EXTENDED ONES WITH ROP

- Let us assume a person of Age 60 wants to purchase a pension policy conventional only as inflapro options are not yet available commercially.

- Let he/she first decide that the policy with ROP is the one to be purchased first

- The rates for individual policy gives better rate of interest say Rs.7110 per lac compared to Rs,7010 for joint life.

- Therefore let the eldest person among the spouse purchase the scheme under LICopt(iii) for individual one

- On the death of the annuitant, the surviving spouse will gets the PURCHASE PRICE.

- Now the spouse will be of certainly higher age than originally thought of opting for joint life.

- If he/she is of around 80 years of age by then, the person on purchasing a fresh policy with the ROP money will get a maximum return for her/his money. Now he/she can decide any other option too on speculation.

- This is the smart option rather than going for joint life policy.

The moral of the story is to propose to LIC to permit rescheduling to switch over to any other option or allow the person to get more rate of pension as per his/her age at that time in the same option also. The LIC can charge a token money out of the outstanding balance (i.e. ROP) for the service/document preparation along with service tax as applicable for fresh purchase.

INFLATION TABLE SINCE THE YEAR 1957

show inflation table| Annual inflation of commodities from the experience of middle class common man from the memory lane |

|||

|---|---|---|---|

| commodity | 1957 | 2010 | inflation pa |

| Paddy | 50.00 | 1200.00 | 6.18% |

| Til oil | 3.00 | 180.00 | 8.03% |

| Soap | 0.30 | 20.00 | 8.25% |

| Gold (8gm soverin) | 75.00 | 14780.00 | 10.48% |

| Rural House rent | 20.00 | 3500.00 | 10.24% |

| Urban House rent | 200.00 | 20000.00 | 9.08% |

| One time a day monthly meal in Lunch home | 20.00 | 900.00 | 7.45% |

| Petrol/litre | 0.90 | 55.00 | 8.07% |

| clerical salary | 30.00 | 12000.00 | 11.97% |

| Officer salary | 180.00 | 50000.00 | 11.20% |

| Part time sevant maid | 5.00 | 700.00 | 9.77% |

| monthly veg budget | 3.00 | 600.00 | 10.51% |

| milk | 0.18 | 32.00 | 10.27% |

| Ghee | 4.00 | 240.00 | 8.03% |

| Enter your known commodity / yr / prices here then move cursor away from that field to another column. |

PreYr | CurYr | See % for your eyes |

ICICI PENSION INCOME ESTIMATE

Table for annuity for Age 62

and five options

click to view ICICI prulife letter to a customer age 62

pension AS INTEREST% age 62

(expectedlife 85yrs)

|

BNV's CALCULATED INTEREST FOR VARIOUS ICICI prulife Options

|

||||||

|---|---|---|---|---|---|---|

|

age |

opttion |

description |

Yearly |

HalfYearly |

Quarterly |

Monthly |

|

Purchase Price=Rs.423014.80 |

||||||

|

62 |

||||||

|

1 |

Life annuity without return of purchase amount |

6.92447% pa |

6.3099% pa |

5.96584% pa |

5.6676% pa |

|

|

2 |

Life annuity with return of purchase amount |

7.26537% pa |

6.78404% pa |

6.522% pa |

6.30096% pa |

|

|

3(a) |

Life annuity guaranteed for 5 years and life thereafter without return of purchase amount |

6.87863% pa |

6.27252% pa |

5.93152% pa |

5.63508% pa |

|

|

3(b) |

Life annuity guaranteed for 10 years and life thereafter without return of purchase amount |

6.76609% pa |

6.17354% pa |

5.84056% pa |

5.5494% pa |

|

|

3(c) |

Life annuity guaranteed for 15 years and life thereafter without return of purchase amount |

6.61355% pa |

6.03798% pa |

5.71184% pa |

5.42628% pa |

|

|

4 |

Joint life last survivor without return of purchase amount |

4.86632% pa |

4.42282% pa |

4.13084% pa |

3.77868% pa |

|

|

5 |

Joint life last survivor with return of purchase amount |

7.27705% pa |

6.80072% pa |

6.52496% pa |

6.24936% pa |

|

Comparatively Interest burden for LIC for life expectancy 85yrs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

LIC.Age | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) |

gauranteed | gauranteed | gauranteed |

30 | 7.59856% |

7.56164% | 7.41082% | 8.3335% | 7.46317% | 7.32771% | 7.37632% |

||

40 | 7.82472% |

7.73502% | 7.46864% | 8.50153% | 7.56824% | 7.32389% | 7.42266% |

||

50 | 8.26596% |

8.00716% | 7.57488% | 8.84524% | 7.74738% | 7.27968% | 7.49434% |

||

60 | 9.01487% |

8.88065% | 6.76609% | 8.17538% |

7.7626% | 9.42403% | 7.94856% | 7.01594% | 7.647% |

70 | 10.22264% |

6.21418% | 8.1141% | 10.13314% | 7.5389% | 5.3638% | 7.96101% |

||

80*) exp.age95) | 20.09608% |

7.32301% | 8.37394% | 20.22579% | 14.54059% | 10.67402% | 8.14948% |

||

| Inference for ICICI scheme Age 62(Purchase Price=Rs.423014.80) LIC scheme age 60(Purchase Price=Rs.416764.00) without considering incentive |

||||||

|---|---|---|---|---|---|---|

| LIC option | ICICI option | scheme desc. | intt. form ICICI as % | intt. form LIC as % | remarks | |

| (i) | 1 | Life annuity without return of purchase amount | yearly | 6.92447% pa | 9.01487% pa | LIC fares better approx. by 2.1% |

| (ii).5 | 3(a) | Life annuity guaranteed for 5 years and life thereafter without return of purchase amount | yearly | 6.87863% pa | 8.88065% pa | LIC fares better approx. by 2.0% |

| (ii).10 | 3(a) | Life annuity guaranteed for 10 years and life thereafter without return of purchase amount | yearly | 6.76609% pa | 8.58147% pa | LIC fares better approx. by 1.82% |

| (ii).15 | 3(c) | Life annuity guaranteed for 15 years and life thereafter without return of purchase amount | yearly | 6.61355% pa | 8.17538% pa | LIC fares better approx. by 1.56% |

| (iii) | 2 | Life annuity with return of purchase amount | yearly | 7.26537% pa | 7.7626% pa | LIC fares better approx. by 0.30% |

| (iv) | nil | LIC Option (iv): Annuity payable for life increasing at a simple rate of 3% p.a. | yearly | not applicable | 9.42403% pa | LIC 3%Inflation protected scheme not available with others |

| (v) | nil | LIC Option (v): Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant. | yearly | not applicable | 7.94856% pa | LIC stands out witn more options to customers |

| (vi) | 4 | Joint life last survivor without return of purchase amount | yearly | 4.86632% pa | 5.3638% pa | LIC fares better approx. by 0.50% |

| (vii) | 5 | Joint life last survivor with return of purchase amount on death of last survivor | yearly | 7.27705% pa | 7.647% pa | LIC fares better approx. by 0.37% |

pension AS INTEREST% age 62

(expectedlife 100yrs)

|

BNV's CALCULATED INTEREST FOR VARIOUS ICICI prulife Options |

||||||

|---|---|---|---|---|---|---|

|

age |

opttion |

description |

Yearly |

HalfYearly |

Quarterly |

Monthly |

|

Purchase Price=Rs.423014.80 |

||||||

|

62 |

||||||

|

1 |

Life annuity without return of purchase amount |

8.55276% pa |

7.92708% pa |

7.58976% pa |

7.31136% pa |

|

|

2 |

Life annuity with return of purchase amount |

7.17598% pa |

6.74122% pa |

6.50108% pa |

6.29412% pa |

|

|

3(a) |

Life annuity guaranteed for 5 years and life thereafter without return of purchase amount |

8.51451% pa |

7.8963% pa |

7.56168% pa |

7.28484% pa |

|

|

3(b) |

Life annuity guaranteed for 10 years and life thereafter without return of purchase amount |

8.42074% pa |

7.81488% pa |

7.48748% pa |

7.21536% pa |

|

|

3(c) |

Life annuity guaranteed for 15 years and life thereafter without return of purchase amount |

8.29389% pa |

7.7036% pa |

7.38256% pa |

7.11564% pa |

|

|

4 |

Joint life last survivor without return of purchase amount |

6.8604% pa |

6.39564% pa |

6.11212% pa |

5.80116% pa |

|

|

5 |

Joint life last survivor with return of purchase amount |

7.1876% pa |

6.75786% pa |

6.50404% pa |

6.24252% pa |

|

Comparatively |

|||||||

|---|---|---|---|---|---|---|---|

LIC.Age | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) |

|

30 | 7.70066% | 7.66498% | 7.40357% | 8.55495% | 7.56988% | 7.43919% | 7.36902% |

40 | 8.03483% | 7.94992% | 7.45354% | 8.89183% | 7.79226% | 7.56188% | 7.40749% |

50 | 8.71354% | 8.47631% | 7.54225% | 9.56804% | 8.239% | 7.81386% | 7.46165% |

60 | 10.06984% | 9.34102% | 7.6863% | 10.92111% | 9.14554% | 8.34827% | 7.57101% |

70 | 13.37963% | 10.25985% | 7.89874% | 14.12617% | 11.27378% | 9.61776% | 7.74836% |

80*(exp.age100) | 21.20976% | 9.62223% | 8.25645% | 21.63249% | 16.09225% | 12.60059% | 8.0344% |

The interest burden for LIC is over 10% for ages 70 and above and maximum is 21.63249% and a good speculation for customers. Higher the interest rate lesser the profit margin or even loss for LIC (service provider)

pension AS INTEREST% age 62

(expectedlife 72yrs)

|

BNV's CALCULATED INTEREST FOR VARIOUS ICICI prulife Options |

||||||

|---|---|---|---|---|---|---|

| age | opttion | description | Yearly | HalfYearly | Quarterly | Monthly |

| Purchase Price=Rs.423014.80 | ||||||

| 62 | ||||||

| 1 | Life annuity without return of purchase amount | -4.05165% pa | -4.36354% pa | -4.61844% pa | -4.91916% pa | |

| ii | Life annuity with return of purchase amount | 7.13634% pa | 6.72138% pa | 6.49114% pa | 6.29074% pa | |

| 3(a) | Life annuity guaranteed for 5 years and life there-after without return of purchase amount | -4.12106% pa | -4.42316% pa | -4.67472% pa | -4.97364% pa | |

| 3(b) | Life annuity guaranteed for 10 years and life thereafter without return of purchase amount | -4.29162% pa | -4.58116% pa | -4.8238% pa | -5.1168% pa | |

| 3(c) | Life annuity guaranteed for 15 years and life thereafter without return of purchase amount | 2.8342% pa | 2.36072% pa | 2.06276% pa | 1.77192% pa | |

| 4 | Joint life last survivor without return of purchase amount | -7.20426% pa | -7.4159% pa | -7.66984% pa | -8.12556% pa | |

| 5 | Joint life last survivor with return of purchase amount | 7.14801% pa | 6.73805% pa | 6.49406% pa | 6.23914% pa | |

| Comparatively Interest burden for LIC for life expectancy 70yrs |

|||||||

|---|---|---|---|---|---|---|---|

| LIC.Age | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) |

|

30 | 7.23971% | 7.19979% | 7.43299% | 7.7088% | 7.09318% | 6.94626% | 7.39853% |

40 | 6.96875% | 6.86654% | 7.51779% | 7.20173% | 6.67607% | 6.39606% | 7.47178% |

50 | 5.85578% | 5.53141% | 7.69696% | 5.61721% | 5.20431% | 4.61167% | 7.61578% |

60 | -1.46282% | 4.27109% | 8.17813% | -2.97656% | -3.10789% | -4.56792% | 8.0574% |

70* | 4.47145% | 6.21418% | 8.35957% | 3.50154% | 1.23212% | -1.41723% | 8.2023% |

80* | 16.08563% | 7.32301% | 8.62644% | 15.53883% | 9.61033% | 5.01295% | 8.3959% |

Part I conclusion

From the above charts of interest burden to ICICI prulife/ LIC can be compared:

for example for the pension policy holder

of entry age 62 (i.e age at the time of starting the annuity/ deposit of purchase price)

and (in case of LIC the rate considered at entry age of 60 which is applicable for age 62)

The expected life upto 85 years

is:

option (vii)

of LIC/

option (5)

of ICICI

scheme:

Joint life annuity

with return of

purchase price

ICICI int% LIC int%

pension per lac

per year Rs.6671 Rs. 7010 yearly

Interest burden/

Return on investment 7.27705% pa 7.647% pa

In addition there is 1% incentive in LIC Scheme for purchase price over Rs.2.5 lacs

with incentive of LIC the comparison looks like:

ICICI int% LIC int%

pension for purchase price

of Rs, 4,23,015.00

per year Rs.28,220 Rs. 29,949.87 yearly

pension per lac

per year Rs.6671 Rs. 7080 yearly

Interest burden/

Return on investment 7.27705% pa 7.72801% pa

In all cases of comparison between ICICI prulife and LIC pension LIC fares better and

gives more benefit to customer.

However in this case study only the option of joint life immediate annuity with return of

purchase price is highlighted.

Also with the investment over Rs. 2.50 lacs, in this case of Rs.4,23,015.00 the benefit to

customer is of the order of Rs. 2500 in case of yearly pension and about Rs.170 in case

of monthly pension over the rates of ICICI.

LIC pension schemes are better than others with more benefit to customer.

Therefore only LIC options are taken for analysis and suggestion for

adopting inflapro options;

AUDIT CHART FOR SELECTED INFLAPRO OPTIONS

FOR ICICI & LIC schemes

shown in following pages

TABLE OF RUN BALANCE (AUDIT TABLE) - ICICI - 5- (inflapro-1)

Principal:423015.00 Rate of Intt:7.27705

Compounding mode:Yearly compounded

ICICI prulife ANNUITY SCHEME 5

entry age=62

Joint life last survivor with return of purchase amount

Option 1 - Conventional-the pension starts at first year and continues with the static pension for the entire period of term

Having maturity value

Term: 23 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 62 | 4,23,015.00 | 28,219.99 | 28,729.43 | 4,23,524.44 | 10.0120 | |

| year 2(1)/AGE 63 | 4,23,524.44 | 28,219.99 | 28,766.50 | 4,24,070.95 | 10.0249 | |

| year 3(1)/AGE 64 | 4,24,070.95 | 28,219.99 | 28,806.27 | 4,24,657.23 | 10.0388 | |

| year 4(1)/AGE 65 | 4,24,657.23 | 28,219.99 | 28,848.94 | 4,25,286.18 | 10.0536 | |

| year 5(1)/AGE 66 | 4,25,286.18 | 28,219.99 | 28,894.71 | 4,25,960.90 | 10.0696 | |

| year 6(1)/AGE 67 | 4,25,960.90 | 28,219.99 | 28,943.80 | 4,26,684.71 | 10.0867 | |

| year 7(1)/AGE 68 | 4,26,684.71 | 28,219.99 | 28,996.48 | 4,27,461.20 | 10.1051 | |

| year 8(1)/AGE 69 | 4,27,461.20 | 28,219.99 | 29,052.98 | 4,28,294.19 | 10.1247 | |

| year 9(1)/AGE 70 | 4,28,294.19 | 28,219.99 | 29,113.60 | 4,29,187.80 | 10.1459 | |

| year 10(1)/AGE 71 | 4,29,187.80 | 28,219.99 | 29,178.63 | 4,30,146.44 | 10.1685 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 22(1)/AGE 83 | 4,46,618.58 | 28,219.99 | 30,447.07 | 4,48,845.66 | 10.6106 | |

| year 23(1)/AGE 84 | 4,48,845.66 | 28,219.99 | 30,609.14 | 4,51,234.81 | 10.6671 | |

| Adjustment | +0.18 | 10.0000 | ||||

| Further pension(on survival) | 28,219.99 | |||||

| Surrender val(on death) | 4,23,015.00 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 1 - Conventional-the pension starts at first year at Rs.28,219.99 Yearly compounded and continues with the static pension for the entire period |

||||||

TABLE OF RUN BALANCE (AUDIT TABLE) - ICICI - 5- (inflapro-4)

Principal:423015.00 Rate of Intt:7.27705

Compounding mode:Yearly compounded

ICICI prulife ANNUITY SCHEME 5

entry age=62

Joint life last survivor with return of purchase amount

Option 4 - Inflapro - pension starts at first year, increases every year, further pension if any will be static after term

Having maturity value

Term: 23 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 62 | 4,23,015.00 | 10,849.47 | 29,993.49 | 4,42,159.02 | 10.4525 | |

| year 2(1)/AGE 63 | 4,42,159.02 | 11,934.42 | 31,307.66 | 4,61,532.26 | 10.9105 | |

| year 3(1)/AGE 64 | 4,61,532.26 | 13,127.86 | 32,630.61 | 4,81,035.01 | 11.3715 | |

| year 4(1)/AGE 65 | 4,81,035.01 | 14,440.65 | 33,954.30 | 5,00,548.66 | 11.8328 | |

| year 5(1)/AGE 66 | 5,00,548.66 | 15,884.72 | 35,269.24 | 5,19,933.18 | 12.2911 | |

| year 6(1)/AGE 67 | 5,19,933.18 | 17,473.19 | 36,564.26 | 5,39,024.25 | 12.7424 | |

| year 7(1)/AGE 68 | 5,39,024.25 | 19,220.51 | 37,826.38 | 5,57,630.12 | 13.1822 | |

| year 8(1)/AGE 69 | 5,57,630.12 | 21,142.56 | 39,040.47 | 5,75,528.03 | 13.6053 | |

| year 9(1)/AGE 70 | 5,75,528.03 | 23,256.82 | 40,189.05 | 5,92,460.26 | 14.0056 | |

| year 10(1)/AGE 71 | 5,92,460.26 | 25,582.50 | 41,251.98 | 6,08,129.74 | 14.3760 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 22(1)/AGE 83 | 5,54,708.25 | 80,288.86 | 34,523.74 | 5,08,943.13 | 12.0313 | |

| year 23(1)/AGE 84 | 5,08,943.13 | 88,317.75 | 30,609.12 | 4,51,234.50 | 10.6671 | |

| Adjustment | +0.49 | 10.0000 | ||||

| Further pension(on survival) | 28,219.99 | |||||

| Surrender val(on death) | 4,23,015.00 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 4 - Inflapro - pension starts at first year at Rs.10,849.47 Yearly compounded and increases @ simple rate of 10% every year for a period of 23 years years further pension static at conventional amount on survival of annuitant beyond 85 years whichever earlier and further pension if any will be static as per conventional amount Rs.28,219.99 after that period for life |

||||||

TABLE OF RUN BALANCE (AUDIT TABLE) - ICICI - 5- (inflapro-7)

Principal:423015.00 Rate of Intt:7.27705

Compounding mode:Yearly compounded

ICICI prulife ANNUITY SCHEME 5

entry age=62

Joint life last survivor with return of purchase amount

Option 7 - Inflapro - pension starts at first year, increases every year, further pension static after term will full as last pension amt

Having maturity value

Term: 23 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 62 | 4,23,015.00 | 7,751.05 | 30,218.97 | 4,45,482.92 | 10.5311 | |

| year 2(1)/AGE 63 | 4,45,482.92 | 8,526.16 | 31,797.56 | 4,68,754.32 | 11.0812 | |

| year 3(1)/AGE 64 | 4,68,754.32 | 9,378.78 | 33,428.99 | 4,92,804.53 | 11.6498 | |

| year 4(1)/AGE 65 | 4,92,804.53 | 10,316.66 | 35,110.88 | 5,17,598.75 | 12.2359 | |

| year 5(1)/AGE 66 | 5,17,598.75 | 11,348.33 | 36,840.10 | 5,43,090.52 | 12.8385 | |

| year 6(1)/AGE 67 | 5,43,090.52 | 12,483.16 | 38,612.56 | 5,69,219.92 | 13.4562 | |

| year 7(1)/AGE 68 | 5,69,219.92 | 13,731.48 | 40,423.17 | 5,95,911.61 | 14.0872 | |

| year 8(1)/AGE 69 | 5,95,911.61 | 15,104.63 | 42,265.61 | 6,23,072.59 | 14.7293 | |

| year 9(1)/AGE 70 | 6,23,072.59 | 16,615.09 | 44,132.22 | 6,50,589.72 | 15.3798 | |

| year 10(1)/AGE 71 | 6,50,589.72 | 18,276.60 | 46,013.74 | 6,78,326.86 | 16.0355 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 22(1)/AGE 83 | 9,24,410.11 | 57,359.82 | 63,095.68 | 9,30,145.97 | 21.9884 | |

| year 23(1)/AGE 84 | 9,30,145.97 | 63,095.80 | 63,095.67 | 9,30,145.84 | 21.9884 | |

| Adjustment | +1.86 | 20.4969 | ||||

| Further pension(on survival) | 63,095.80 | |||||

| Surrender val(on death) | 8,67,051.90 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 7 - Inflapro - pension starts at first year at Rs.7,751.05 Yearly compounded , increases @ simple rate of 10% every year for a period of 23 years years further pension static at 100% of last pension amount on survival of annuitant beyond 85 years or period of of 23 years years whichever later on survival Rs.63,095.80 for life. The return of purchase price will be as per NAV max of 20.4969 |

||||||

TABLE OF RUN BALANCE (AUDIT TABLE)- LIC (vii) - inflapro:(1)

Principal:423015.00 Rate of Intt:7.72801

Compounding mode:Yearly compounded

LIC JEEVAN AKSHAY IV SCHEME OPTION vii entry age=60

Option (vii) Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor. No.of Years=25

Option 1 - Conventional-the pension starts at first year and continues with the static pension for the entire period of term

Having maturity value

Term: 25 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 60 | 4,23,015.00 | 29,949.87 | 30,376.11 | 4,23,441.24 | 10.0100 | |

| year 2(1)/AGE 61 | 4,23,441.24 | 29,949.87 | 30,409.05 | 4,23,900.42 | 10.0209 | |

| year 3(1)/AGE 62 | 4,23,900.42 | 29,949.87 | 30,444.54 | 4,24,395.09 | 10.0326 | |

| year 4(1)/AGE 63 | 4,24,395.09 | 29,949.87 | 30,482.77 | 4,24,927.99 | 10.0452 | |

| year 5(1)/AGE 64 | 4,24,927.99 | 29,949.87 | 30,523.95 | 4,25,502.07 | 10.0587 | |

| year 6(1)/AGE 65 | 4,25,502.07 | 29,949.87 | 30,568.31 | 4,26,120.51 | 10.0734 | |

| year 7(1)/AGE 66 | 4,26,120.51 | 29,949.87 | 30,616.11 | 4,26,786.75 | 10.0891 | |

| year 8(1)/AGE 67 | 4,26,786.75 | 29,949.87 | 30,667.59 | 4,27,504.47 | 10.1061 | |

| year 9(1)/AGE 68 | 4,27,504.47 | 29,949.87 | 30,723.06 | 4,28,277.66 | 10.1244 | |

| year 10(1)/AGE 69 | 4,28,277.66 | 29,949.87 | 30,782.81 | 4,29,110.60 | 10.1440 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 24(1)/AGE 83 | 4,48,059.06 | 29,949.87 | 32,311.52 | 4,50,420.71 | 10.6478 | |

| year 25(1)/AGE 84 | 4,50,420.71 | 29,949.87 | 32,494.03 | 4,52,964.87 | 10.7080 | |

| Adjustment | 0.00 | 10.0000 | ||||

| Further pension(on survival) | 29,949.87 | |||||

| Surrender val(on death) | 4,23,015.00 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 1 - Conventional-the pension starts at first year at Rs.29,949.87 Yearly compounded and continues with the static pension for the entire period for life with a provision of of the conventional annuity payable to spouse during his/ her life time on death of annuitant. with return of purchase price on the death of last survivor |

||||||

TABLE OF RUN BALANCE (AUDIT TABLE)- LIC (vii) - inflapro:(4)

Principal:423015.00 Rate of Intt:7.72801

Compounding mode:Yearly compounded

LIC JEEVAN AKSHAY IV SCHEME OPTION vii entry age=60

Option (vii) Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor. No.of Years=25

Option 4 - Inflapro - pension starts at first year, increases every year, further pension if any will be static after term

Having maturity value

Term: 25 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 60 | 4,23,015.00 | 10,854.99 | 31,851.77 | 4,44,011.78 | 10.4963 | |

| year 2(1)/AGE 61 | 4,44,011.78 | 11,940.49 | 33,390.51 | 4,65,461.80 | 11.0034 | |

| year 3(1)/AGE 62 | 4,65,461.80 | 13,134.54 | 34,955.90 | 4,87,283.16 | 11.5192 | |

| year 4(1)/AGE 63 | 4,87,283.16 | 14,447.99 | 36,540.75 | 5,09,375.92 | 12.0415 | |

| year 5(1)/AGE 64 | 5,09,375.92 | 15,892.79 | 38,136.43 | 5,31,619.56 | 12.5673 | |

| year 6(1)/AGE 65 | 5,31,619.56 | 17,482.07 | 39,732.60 | 5,53,870.09 | 13.0933 | |

| year 7(1)/AGE 66 | 5,53,870.09 | 19,230.28 | 41,317.02 | 5,75,956.83 | 13.6155 | |

| year 8(1)/AGE 67 | 5,75,956.83 | 21,153.31 | 42,875.27 | 5,97,678.79 | 14.1290 | |

| year 9(1)/AGE 68 | 5,97,678.79 | 23,268.64 | 44,390.47 | 6,18,800.62 | 14.6283 | |

| year 10(1)/AGE 69 | 6,18,800.62 | 25,595.50 | 45,842.95 | 6,39,048.07 | 15.1069 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 24(1)/AGE 83 | 5,86,756.42 | 97,198.90 | 37,833.05 | 5,27,390.57 | 12.4674 | |

| year 25(1)/AGE 84 | 5,27,390.57 | 1,06,918.79 | 32,494.10 | 4,52,965.88 | 10.7080 | |

| Adjustment | -1.01 | 10.0000 | ||||

| Further pension(on survival) | 29,949.87 | |||||

| Surrender val(on death) | 4,23,015.00 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 4 - Inflapro - pension starts at first year at Rs.10,854.99 Yearly compounded and increases @ simple rate of 10% every year for a period of 25 years years for life with a provision of of the conventional annuity payable to spouse during his/ her life time on death of annuitant. with return of purchase price on the death of last survivor In case of premature death return of purchase price is as per nav to a MAX of 17.0784 further pension static at conventional amount on survival of annuitant beyond 85 years whichever earlier and further pension if any will be static as per conventional amount Rs.29,949.87 after that period for life |

||||||

TABLE OF RUN BALANCE (AUDIT TABLE)- LIC (vii) - inflapro:(7)

Principal:423015.00 Rate of Intt:7.72801

Compounding mode:Yearly compounded

LIC JEEVAN AKSHAY IV SCHEME OPTION vii entry age=60

Option (vii) Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor. No.of Years=25

Option 7 - Inflapro - pension starts at first year, increases every year, further pension static after term will full as last pension amt

Having maturity value

Term: 25 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 60 | 4,23,015.00 | 7,857.84 | 32,083.39 | 4,47,240.55 | 10.5726 | |

| year 2(1)/AGE 61 | 4,47,240.55 | 8,643.62 | 33,894.81 | 4,72,491.74 | 11.1696 | |

| year 3(1)/AGE 62 | 4,72,491.74 | 9,507.98 | 35,779.43 | 4,98,763.19 | 11.7906 | |

| year 4(1)/AGE 63 | 4,98,763.19 | 10,458.78 | 37,736.21 | 5,26,040.62 | 12.4355 | |

| year 5(1)/AGE 64 | 5,26,040.62 | 11,504.66 | 39,763.39 | 5,54,299.35 | 13.1035 | |

| year 6(1)/AGE 65 | 5,54,299.35 | 12,655.13 | 41,858.32 | 5,83,502.54 | 13.7938 | |

| year 7(1)/AGE 66 | 5,83,502.54 | 13,920.64 | 44,017.35 | 6,13,599.25 | 14.5053 | |

| year 8(1)/AGE 67 | 6,13,599.25 | 15,312.70 | 46,235.64 | 6,44,522.19 | 15.2363 | |

| year 9(1)/AGE 68 | 6,44,522.19 | 16,843.97 | 48,507.04 | 6,76,185.26 | 15.9849 | |

| year 10(1)/AGE 69 | 6,76,185.26 | 18,528.37 | 50,823.79 | 7,08,480.68 | 16.7483 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 24(1)/AGE 83 | 10,71,881.80 | 70,361.46 | 77,397.59 | 10,78,917.93 | 25.5054 | |

| year 25(1)/AGE 84 | 10,78,917.93 | 77,397.61 | 77,397.59 | 10,78,917.91 | 25.5054 | |

| Adjustment | +0.27 | 23.6757 | ||||

| Further pension(on survival) | 77,397.61 | |||||

| Surrender val(on death) | 10,01,520.57 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 7 - Inflapro - pension starts at first year at Rs.7,857.84 Yearly compounded , increases @ simple rate of 10% every year for a period of 25 years years for life with a provision of 100% of the last annuity payable to spouse during his/ her life time on death of annuitant. with return of purchase price on the death of last survivor further pension static at 100% of last pension amount on survival of annuitant beyond 85 years or period of of 25 years years whichever later on survival Rs.77,397.61 for life. The return of purchase price will be as per NAV max of 23.6757 |

||||||

Audit table for Suggestion of

100% to spouse/50% after term on survival

ROP as per NAV

TABLE OF RUN BALANCE (AUDIT TABLE)- LIC (vii) - inflapro:(10)

Principal:423015.00 Rate of Intt:7.72801

Compounding mode:Yearly compounded

LIC JEEVAN AKSHAY IV SCHEME OPTION vii entry age=60

Option (vii) Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor. No.of Years=25

Option 10 - Inflapro - pension starts at first year, increases every year, further pension static after term will half as last pension amt

Having maturity value

Term: 25 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 60 | 4,23,015.00 | 9,801.83 | 31,933.16 | 4,45,146.33 | 10.5231 | |

| year 2(1)/AGE 61 | 4,45,146.33 | 10,782.01 | 33,567.72 | 4,67,932.04 | 11.0618 | |

| year 3(1)/AGE 62 | 4,67,932.04 | 11,860.21 | 35,245.28 | 4,91,317.11 | 11.6146 | |

| year 4(1)/AGE 63 | 4,91,317.11 | 13,046.23 | 36,960.82 | 5,15,231.70 | 12.1799 | |

| year 5(1)/AGE 64 | 5,15,231.70 | 14,350.85 | 38,708.12 | 5,39,588.97 | 12.7557 | |

| year 6(1)/AGE 65 | 5,39,588.97 | 15,785.94 | 40,479.55 | 5,64,282.58 | 13.3395 | |

| year 7(1)/AGE 66 | 5,64,282.58 | 17,364.53 | 42,265.88 | 5,89,183.93 | 13.9282 | |

| year 8(1)/AGE 67 | 5,89,183.93 | 19,100.98 | 44,056.07 | 6,14,139.02 | 14.5181 | |

| year 9(1)/AGE 68 | 6,14,139.02 | 21,011.08 | 45,836.99 | 6,38,964.93 | 15.1050 | |

| year 10(1)/AGE 69 | 6,38,964.93 | 23,112.19 | 47,593.16 | 6,63,445.90 | 15.6837 | |

| year 11(1)/AGE 70 | 6,63,445.90 | 25,423.41 | 49,306.44 | 6,87,328.93 | 16.2483 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 24(1)/AGE 83 | 7,57,224.02 | 87,768.52 | 51,735.59 | 7,21,191.09 | 17.0488 | |

| year 25(1)/AGE 84 | 7,21,191.09 | 96,545.37 | 48,272.68 | 6,72,918.40 | 15.9076 | |

| Adjustment | +0.09 | 14.7665 | ||||

| Further pension(on survival) | 48,272.69 | |||||

| Surrender val(on death) | 6,24,645.80 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 10 - Inflapro - pension starts at first year at Rs.9,801.83 Yearly compounded and increases @ simple rate of 10% every year for a period of 25 years years for life with a provision of 50% of the last annuity payable to spouse during his/ her life time on death of annuitant. with return of purchase price on the death of last survivor further pension static at 50% of last pension amount on survival of annuitant beyond 85 years or period of of 25 years years whichever later on survival, half the last pension i.e. Rs.48,272.69 for life. The return of purchase price will be as per NAV max of 14.7665 |

||||||

CHART OF PROPOSED TABLE OF PENSION IN RUPEES AGE=60 TERM=25

clickable at respective columns of the chart.

click to see the INFLAPRO chart

of this page in new tab/window

PROPOSED TABLE OF PENSION in RUPEES age=60 term=25

Principal:423015.00Rate of Intt:7.72801

Compounding mode:Yearly compounded

LIC JEEVAN AKSHAY IV SCHEME OPTION vii entry age=60

Option (vii) Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor. No.of Years=25

Term: 25 years Moratorium-(option2,5,8,11): 5 years

Moratorium-(option3,6,9,12): 10 years

| LIC PENSION SCHEMES AKSHAY IV purchase price=100000 plus sevice tax | |||||||

|---|---|---|---|---|---|---|---|

| Age | (i) | (ii) | (III) | (IV) | (V) | (VI) | (VII) |

| The option iv is aleredy 3% inflation protected | |||||||

| 030 | 7190 | 7160 | 6890 | 5250 | 7080 | 6970 | 6860 |

| 040 | 7510 | 7440 | 6930 | 5610 | 7310 | 7120 | 6890 |

| 050 | 8140 | 7950 | 7000 | 6280 | 7760 | 7420 | 6930 |

| 060 | 9350 | 8790 | 7110 | 7530 | 8640 | 8030 | 7010 |

| 070 | 12080 | 9830 | 7260 | 10220 | 10560 | 9370 | 7130 |

| 080 | 17880 | 10440 | 7480 | 15890 | 14600 | 12340 | 7290 |

| Extended option 4 (proposed) rates below are per lac | |||||||

| 060 | Ext.opt (1-4) 3583 | (2-4) 3249 | (3-4) 2580.86 | (4-4) 7530 | (5-4)3162 | (6-4) 2820 | (7-4) 2531.64 |

| Extended option 7 (proposed) rates below are per lac | |||||||

| 060 | Ext.opt (1-7)NA | | (2-7)NA | | (3-7) 1871.28 | (4-7)NA | | (5-7)NA | | (6-7)NA | | (7-7) 1825.66 |

| INFLAPRO LIC for clickable links of above table | |||||||

Comparatively Interest burden for LIC for life expectancy 85yrs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

LIC.Age | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) |

gauranteed | gauranteed | gauranteed |

30 | 7.59856% |

7.56164% | 7.41082% | 8.3335% | 7.46317% | 7.32771% | 7.37632% |

||

40 | 7.82472% |

7.73502% | 7.46864% | 8.50153% | 7.56824% | 7.32389% | 7.42266% |

||

50 | 8.26596% |

8.00716% | 7.57488% | 8.84524% | 7.74738% | 7.27968% | 7.49434% |

||

60 | 9.01487% |

8.88065% | 6.76609% | 8.17538% |

7.7626% | 9.42403% | 7.94856% | 7.01594% | 7.647% |

70 | 10.22264% |

6.21418% | 8.1141% | 10.13314% | 7.5389% | 5.3638% | 7.96101% |

||

80*) exp.age95) | 20.09608% |

7.32301% | 8.37394% | 20.22579% | 14.54059% | 10.67402% | 8.14948% |

||

SUGGESTED START-AMT AND END-PMT PERLAC FOR LIC AND INFLAPRO OPTION-4

| Suggested start-amt and end-pmt perlac for LIC for life expectancy 85yrs

and inflapro option-4, for option(iii) & (vii) retun of purch.price=100000 per lac for option (i)(ii)(iv)(v) & (vi) return of purch.price=0 on death of annuitant or last survivor within the term(refer col.2*) Survival pension after the full term will be static conventional amount(also ref table below) |

||||||||

|---|---|---|---|---|---|---|---|---|

| LIC | full term | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) |

| entry age | years | increase: 10% pa | increase: 10% pa | increase: 10% pa | increase: 3% pa | increase: 10% pa | increase: 10% pa | increase: 10% pa |

| --- | start:end | start:end | start:end | start:end | start:end | start:end | start:end | |

30 | 55 | 942.90 : 162059.00 7190 | 7190 | 932.45 : 160263.43 7160 | 7160 | 872.01 : 149872.94 6890 | 6890 | 5250.00 : 25904.15 7788 | 7788 | 905.00 : 155546.39 7080 | 3540 | 849.28 : 145968.34 6970 | 6970 | 862.52 : 148243.94 6860 | 6860 |

40 | 45 | 1384.95 : 91773.40 7510 | 7510 | 1356.00 : 89854.34 7440 | 7440 | 1219.33 : 80797.37 6930 | 6930 | 5610.00 : 20596.88 8040 | 8040 | 1303.30 : 86362.38 7310 | 3655 | 1174.24 : 77810.12 7120 | 7120 | 1204.87 : 79840.87 6890 | 6890 |

50 | 35 | 2152.99 : 55003.85 8140 | 8140 | 2058.59 : 52592.33 7950 | 7950 | 1748.71 : 44675.41 7000 | 7000 | 6280.00 : 17156.38 8568 | 8568 | 1966.65 : 50243.56 7760 | 3880 | 1643.23 : 41980.82 7420 | 7420 | 1719.59 : 43931.72 6930 | 6930 |

60 | 25 | 3583.13 : 35292.84 9350 | 9350 | 3248.87 : 32000.65 8790 | 8790 | 2580.86 : 25420.96 7110 | 7110 | 7530.00 : 15306.95 9625 | 9625 | 3161.95 : 31144.56 8640 | 4320 | 2819.82 : 27774.51 8030 | 8030 | 2531.64 : 24936.00 7010 | 7010 |

70 | 15 | 6761.44 : 25676.54 12080 | 12080 | 5157.95 : 19587.32 9830 | 9830 | 3929.80 : 14923.44 7260 | 7260 | 10220.00 : 15458.66 12029 | 12029 | 5662.99 : 21505.19 10560 | 5280 | 4847.41 : 18408.07 9370 | 9370 | 3849.89 : 14619.97 7130 | 7130 |

80* | 15 | 11482.81 : 43605.97 17880 | 17880 | 5578.95 : 21186.10 10440 | 10440 | 4065.88 : 15440.23 7480 | 7480 | 15890.00 : 24035.04 17956 | 17956 | 8714.94 : 33094.94 14600 | 7300 | 6955.50 : 26413.54 12340 | 12340 | 3948.30 : 14993.67 7290 | 7290 |

| Suggested conventional amount perlac for LIC for life expectancy 85yrs for the table above for survival beyond the full term (col 2) increase per year for suvival beyond full term= 0% The rates beyond term is same as conventional Master rates as given previously |

||||||||

|---|---|---|---|---|---|---|---|---|

| LIC.Age | full term | (i) | (ii) | (iii) | (iv) | (v)(half-amt) | (vi) | (vii) |

| 30 | 55 | 7190 | 7160 | 6890 | 5250 | 3540 | 6970 | 6860 |

| 40 | 45 | 7510 | 7440 | 6930 | 5610 | 3655 | 7120 | 6890 |

| 50 | 35 | 8140 | 7950 | 7000 | 6280 | 3880 | 7420 | 6930 |

| 60 | 25 | 9350 | 8790 | 7110 | 7530 | 4320 | 8030 | 7010 |

| 70 | 15 | 12080 | 9830 | 7260 | 10220 | 5280 | 9370 | 7130 |

| 80* exp.age 95 | 15 | 17880 | 10440 | 7480 | 15890 | 7300 | 12340 | 7290 |

SUGGESTED START-AMT AND END-PMT PERLAC FOR LIC AND INFLAPRO OPTION-7

| Suggested start-amt and end-pmt perlac for LIC for life expectancy 85yrs

and inflapro option-7, for LICoption(iii) & (vii) retun of purch.price=As Per NAV for LICoption (i)(ii)(iv)(v) & (vi) this extended scheme is not suggested to be applied This scheme be applied only to the existing annuity scheme with return of Purchase Price (ROP) only. |

||||||||

|---|---|---|---|---|---|---|---|---|

| LIC | full term | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) |

| entry age | years | increase: 10% pa | increase: 10% pa | increase: 10% pa | increase: 3% pa | increase: 10% pa | increase: 10% pa | increase: 10% pa |

| --- | start:end | start:end | start:end | start:end | start:end | start:end | start:end | |

30 | 55 | 620.69 : 106679.78 6890 | 106680 | 612.03 : 105192.30 6860 | 105192 |

|||||

40 | 45 | 862.98 : 57184.85 6930 | 57185 | 849.63 : 56300.79 6890 | 56301 |

|||||

50 | 35 | 1240.62 : 31695.02 7000 | 31695 | 1213.51 : 31002.63 6930 | 31003 |

|||||

60 | 25 | 1871.28 : 18431.68 7110 | 18432 | 1825.66 : 17982.37 7010 | 17982 |

|||||

70 | 15 | 3060.19 : 11621.06 7260 | 11621 | 2987.05 : 11343.35 7130 | 11343 |

|||||

80* | 15 | 3185.43 : 12096.69 7480 | 12097 | 3077.15 : 11685.53 7290 | 11686 |

|||||

| Suggested Maximum ROP perlac for LIC for life expectancy 85yrs for the table above of inflapro-option-7 with Return of Purchase Price as per NAV. The Maximum permissible ROP is given in this table. |

||||||||

|---|---|---|---|---|---|---|---|---|

| LIC/age | full term | (i) | (ii) | (iii) | (iv) | (v) | (vi) | (vii) |

30 | 55 | 1439513.85 | 1426081.03 |

|||||

40 | 45 | 765666.17 | 758498.84 |

|||||

50 | 35 | 418422.73 | 413680.59 |

|||||

60 | 25 | 237442.09 | 235155.88 |

|||||

70 | 15 | 143220.57 | 142486.32 |

|||||

80* | 15 | 144456.37 | 143389.88 |

|||||

AUDIT TABLE INFLAPRO OPT 7 RECOMMENDED FAIR SHEME HIGH YIELD NO LOSS/NO GAIN

TABLE OF RUN BALANCE (AUDIT TABLE) LICOPT(vii) - extended/inflapro opt(7)

Principal:100000.00 Rate of Intt:7.647

Compounding mode:Yearly compounded

LIC JEEVAN AKSHAY IV SCHEME OPTION vii entry age=60

Option (vii) Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her life time on death of annuitant. The purchase price will be returned on the death of last survivor. No.of Years=25

Option 7 - Inflapro - pension starts at first year, increases every year, further pension static after term will full as last pension amt

Having maturity value

Term: 25 years Moratorium=NIL

| Year | B/F | Payout | Interest | C/O/Balance | NAV(FV:10) | |

|---|---|---|---|---|---|---|

| year 1(1)/AGE 60 | 1,00,000.00 | 1,825.66 | 7,507.39 | 1,05,681.73 | 10.5681 | |

| year 2(1)/AGE 61 | 1,05,681.73 | 2,008.23 | 7,927.91 | 1,11,601.41 | 11.1601 | |

| year 3(1)/AGE 62 | 1,11,601.41 | 2,209.05 | 8,365.23 | 1,17,757.59 | 11.7757 | |

| year 4(1)/AGE 63 | 1,17,757.59 | 2,429.96 | 8,819.10 | 1,24,146.73 | 12.4146 | |

| year 5(1)/AGE 64 | 1,24,146.73 | 2,672.96 | 9,289.10 | 1,30,762.87 | 13.0762 | |

| year 6(1)/AGE 65 | 1,30,762.87 | 2,940.26 | 9,774.59 | 1,37,597.20 | 13.7597 | |

| year 7(1)/AGE 66 | 1,37,597.20 | 3,234.29 | 10,274.73 | 1,44,637.64 | 14.4637 | |

| year 8(1)/AGE 67 | 1,44,637.64 | 3,557.72 | 10,788.38 | 1,51,868.30 | 15.1868 | |

| year 9(1)/AGE 68 | 1,51,868.30 | 3,913.49 | 11,314.10 | 1,59,268.91 | 15.9268 | |

| year 10(1)/AGE 69 | 1,59,268.91 | 4,304.84 | 11,850.10 | 1,66,814.17 | 16.6814 | |

| ~ | ~ continued (click here to see full) | ~ | ~ | ~ | ||

| year 24(1)/AGE 83 | 2,51,502.08 | 16,347.61 | 17,982.26 | 2,53,136.73 | 25.3136 | |

| year 25(1)/AGE 84 | 2,53,136.73 | 17,982.37 | 17,982.25 | 2,53,136.61 | 25.3136 | |

| Adjustment | +1.64 | 23.5155 | ||||

| Further pension(on survival) | 17,982.37 | |||||

| Surrender val(on death) | 2,35,155.88 | |||||

| ||||||

| Suggested INFLAPRO OPTIONS:

Option 7 - Inflapro - pension starts at first year at Rs.1,825.66 Yearly compounded , increases @ simple rate of 10% every year for a period of 25 years years for life with a provision of 100% of the last annuity payable to spouse during his/ her life time on death of annuitant. with return of purchase price on the death of last survivor further pension static at 100% of last pension amount on survival of annuitant beyond 85 years or period of of 25 years years whichever later on survival Rs.17,982.37 for life. The return of purchase price will be as per NAV max of 23.5155 |

||||||

SUMMARY OF OF INCREASE/DECRESE IN PROFIT MARGIN FOR LICOPT (I) TO (VII) EXT.OPT 4

Summary of of increase/decrese in profit margin for LICopt (i) to (vii) ext.opt 4

click the respective table/column to view full calculation for LICoption (i) to (vii) extended option 4 of inflapro

| Conventional opt(i) intt=9.01487% infla=0% | |

|---|---|

| Age | Profit Index |

| 60 | +0.99 |

| 61 | +0.98 |

| 62 | +0.96 |

| 63 | +0.95 |

| 64 | +0.93 |

| 65 | +0.91 |

| 66 | +0.89 |

| 67 | +0.87 |

| 68 | +0.85 |

| 69 | +0.82 |

| 70 | +0.79 |

| 71 | +0.76 |

| 72 | +0.73 |

| 73 | +0.69 |

| 74 | +0.65 |

| 75 | +0.61 |

| 76 | +0.56 |

| 77 | +0.51 |

| 78 | +0.46 |

| 79 | +0.40 |

| 80 | +0.33 |

| 81 | +0.26 |

| 82 | +0.18 |

| 83 | +0.09 |

| 84 | +0.00 |

| 85 | -0.10 |

| 86 | -0.21 |

| 87 | -0.33 |

| 88 | -0.47 |

| 89 | -0.61 |

| 90 | -0.77 |

| 91 | -0.94 |

| 92 | -1.12 |

| 93 | -1.33 |

| 94 | -1.55 |

| 95 | -1.79 |

| 96 | -2.05 |

| 97 | -2.34 |

| 98 | -2.65 |

| 99 | -3.00 |

| 100 | -3.37 |

| licopt(i) ext.opt(4) intt=9.01487% infla=10% | |

|---|---|

| Age | Profit inc/dec |

| 60 | +0.06 |

| 61 | +0.13 |

| 62 | +0.19 |

| 63 | +0.26 |

| 64 | +0.33 |

| 65 | +0.40 |

| 66 | +0.47 |

| 67 | +0.53 |

| 68 | +0.60 |

| 69 | +0.66 |

| 70 | +0.73 |

| 71 | +0.78 |

| 72 | +0.83 |

| 73 | +0.87 |

| 74 | +0.91 |

| 75 | +0.93 |

| 76 | +0.93 |

| 77 | +0.92 |

| 78 | +0.89 |

| 79 | +0.83 |

| 80 | +0.75 |

| 81 | +0.63 |

| 82 | +0.47 |

| 83 | +0.26 |

| 84 | +0.00 |

| 85 | +0.00 |

| 86 | +0.00 |

| 87 | +0.00 |

| 88 | +0.00 |

| 89 | +0.00 |

| 90 | +0.00 |

| 91 | +0.00 |

| 92 | +0.00 |

| 93 | +0.00 |

| 94 | +0.00 |

| 95 | +0.00 |

| 96 | +0.00 |

| 97 | +0.00 |

| 98 | +0.00 |

| 99 | +0.00 |

| 100 | +0.00 |

| licopt(ii) ext.opt(4) intt=8.17538% infla=10% | |

|---|---|

| Age | Profit inc/dec |

| 60 | +0.06 |

| 61 | +0.12 |

| 62 | +0.18 |

| 63 | +0.25 |

| 64 | +0.31 |

| 65 | +0.37 |

| 66 | +0.44 |

| 67 | +0.50 |

| 68 | +0.56 |

| 69 | +0.62 |

| 70 | +0.67 |

| 71 | +0.72 |

| 72 | +0.77 |

| 73 | +0.80 |

| 74 | +0.83 |

| 75 | +0.85 |

| 76 | +0.85 |

| 77 | +0.84 |

| 78 | +0.81 |

| 79 | +0.75 |

| 80 | +0.67 |

| 81 | +0.56 |

| 82 | +0.42 |

| 83 | +0.23 |

| 84 | +0.00 |

| 85 | +0.00 |

| 86 | +0.00 |

| 87 | +0.00 |

| 88 | +0.00 |

| 89 | +0.00 |

| 90 | +0.00 |

| 91 | +0.00 |

| 92 | +0.00 |

| 93 | +0.00 |

| 94 | +0.00 |

| 95 | +0.00 |

| 96 | +0.00 |

| 97 | +0.00 |

| 98 | +0.00 |

| 99 | +0.00 |

| 100 | +0.00 |

| licopt(iii) ext.opt(4) intt=7.7626% infla=10% | |

|---|---|

| Age | Profit inc/dec |

| 60 | 0.00 |

| 61 | 0.00 |

| 62 | 0.00 |

| 63 | -0.00 |

| 64 | -0.00 |

| 65 | -0.00 |

| 66 | -0.00 |

| 67 | -0.00 |

| 68 | -0.00 |

| 69 | 0.00 |

| 70 | -0.00 |

| 71 | -0.00 |

| 72 | 0.00 |

| 73 | -0.00 |

| 74 | -0.00 |

| 75 | 0.00 |

| 76 | 0.00 |

| 77 | 0.00 |

| 78 | -0.00 |

| 79 | 0.00 |

| 80 | -0.00 |

| 81 | 0.00 |

| 82 | 0.00 |

| 83 | -0.00 |

| 84 | 0.00 |

| 85 | 0.00 |

| 86 | 0.00 |

| 87 | 0.00 |

| 88 | 0.00 |

| 89 | 0.00 |

| 90 | 0.00 |

| 91 | 0.00 |

| 92 | 0.00 |

| 93 | 0.00 |

| 94 | 0.00 |

| 95 | 0.00 |

| 96 | 0.00 |

| 97 | 0.00 |

| 98 | 0.00 |

| 99 | 0.00 |

| 100 | 0.00 |

| licopt(iv) ext.opt(4) intt=9.42403% infla=3% | |

|---|---|

| Age | Profit inc/dec |

| 60 | +0.00 |

| 61 | +0.00 |

| 62 | +0.00 |

| 63 | +0.00 |

| 64 | +0.00 |

| 65 | +0.00 |

| 66 | +0.00 |

| 67 | +0.00 |

| 68 | +0.00 |

| 69 | +0.00 |

| 70 | +0.00 |

| 71 | +0.00 |

| 72 | +0.00 |

| 73 | +0.00 |

| 74 | +0.00 |

| 75 | +0.00 |

| 76 | +0.00 |

| 77 | +0.00 |

| 78 | +0.00 |

| 79 | +0.00 |

| 80 | +0.00 |

| 81 | +0.00 |

| 82 | +0.00 |

| 83 | +0.00 |

| 84 | +0.00 |

| 85 | +0.00 |

| 86 | +0.00 |

| 87 | +0.00 |

| 88 | +0.00 |

| 89 | +0.00 |

| 90 | +0.00 |

| 91 | +0.00 |

| 92 | +0.00 |

| 93 | +0.00 |

| 94 | +0.00 |

| 95 | +0.00 |

| 96 | +0.00 |

| 97 | +0.00 |

| 98 | +0.00 |

| 99 | +0.00 |

| 100 | +0.00 |

| licopt(v) ext.opt(4) intt=7.94856% infla=10% | |

|---|---|

| Age | Profit inc/dec |

| 60 | +0.06 |

| 61 | +0.12 |

| 62 | +0.18 |

| 63 | +0.24 |

| 64 | +0.31 |

| 65 | +0.37 |

| 66 | +0.43 |

| 67 | +0.49 |

| 68 | +0.55 |

| 69 | +0.61 |

| 70 | +0.66 |

| 71 | +0.71 |

| 72 | +0.75 |

| 73 | +0.79 |

| 74 | +0.81 |

| 75 | +0.83 |

halving | |

| 76 | +0.87 |

| 77 | +0.91 |

| 78 | +0.94 |

| 79 | +0.96 |

| 80 | +0.98 |

| 81 | +0.99 |

| 82 | +0.99 |

| 83 | +0.98 |

| 84 | +0.95 |

| 85 | +0.98 |

| 86 | +1.01 |

| 87 | +1.05 |

| 88 | +1.08 |

| 89 | +1.12 |

| 90 | +1.16 |

| 91 | +1.21 |

| 92 | +1.26 |

| 93 | +1.31 |

| 94 | +1.37 |

| 95 | +1.43 |

| 96 | +1.50 |

| 97 | +1.57 |

| 98 | +1.65 |

| 99 | +1.74 |

| 100 | +1.83 |

| assumptions for special case of (v) death of annuitant at age 75 and 50% thereof to spouse inflapro continued | |

| licopt(vi) ext.opt(4) intt=7.01594% infla=10% | |

|---|---|

| Age | Profit inc/dec |

| 60 | +0.06 |

| 61 | +0.11 |

| 62 | +0.17 |

| 63 | +0.23 |

| 64 | +0.29 |

| 65 | +0.34 |

| 66 | +0.40 |

| 67 | +0.45 |

| 68 | +0.51 |

| 69 | +0.56 |

| 70 | +0.60 |

| 71 | +0.65 |

| 72 | +0.68 |

| 73 | +0.71 |

| 74 | +0.73 |

| 75 | +0.75 |

| 76 | +0.75 |

| 77 | +0.73 |

| 78 | +0.70 |

| 79 | +0.65 |

| 80 | +0.58 |

| 81 | +0.48 |

| 82 | +0.36 |

| 83 | +0.20 |

| 84 | +0.00 |

| 85 | +0.00 |

| 86 | +0.00 |

| 87 | +0.00 |

| 88 | +0.00 |

| 89 | +0.00 |

| 90 | +0.00 |

| 91 | +0.00 |

| 92 | +0.00 |

| 93 | +0.00 |

| 94 | +0.00 |

| 95 | +0.00 |

| 96 | +0.00 |

| 97 | +0.00 |

| 98 | +0.00 |

| 99 | +0.00 |

| 100 | +0.00 |

| licopt(vii) ext.opt(4) intt=7.647% infla=10% | |

|---|---|

| Age | Profit inc/dec |

| 60 | 0.00 |

| 61 | 0.00 |

| 62 | 0.00 |

| 63 | 0.00 |

| 64 | 0.00 |

| 65 | 0.00 |

| 66 | 0.00 |

| 67 | 0.00 |

| 68 | 0.00 |

| 69 | -0.00 |

| 70 | -0.00 |

| 71 | -0.00 |

| 72 | 0.00 |

| 73 | -0.00 |

| 74 | -0.00 |

| 75 | -0.00 |

| 76 | 0.00 |

| 77 | -0.00 |

| 78 | 0.00 |

| 79 | 0.00 |

| 80 | -0.00 |

| 81 | 0.00 |

| 82 | -0.00 |

| 83 | 0.00 |

| 84 | 0.00 |

| 85 | 0.00 |

| 86 | 0.00 |

| 87 | 0.00 |

| 88 | 0.00 |

| 89 | 0.00 |

| 90 | 0.00 |

| 91 | 0.00 |

| 92 | 0.00 |

| 93 | 0.00 |

| 94 | 0.00 |

| 95 | 0.00 |

| 96 | 0.00 |

| 97 | 0.00 |

| 98 | 0.00 |

| 99 | 0.00 |

| 100 | 0.00 |

end of profit table

STATE BANK OF INDIA SCHEME MONTHLY RS.1000